A fixed exchange rate is a system where the value of a currency is fixed against other currencies. It is used to stabilize the value of a currency by fixing it in a determined ratio to a more stable currency. In this way, the exchange rates won’t be affected by market conditions the way they do under floating currencies. This option will make trade between countries more predictable which is helpful to small economies since they rely heavily on international trade. Furthermore, a fixed exchange rate system controls the behavior of the currency by limiting rates of inflation for example. Many Mediterranean countries have shaped this regime believing that it will help them gain monetary policy credibility and stability. In Lebanon, fixed exchange rate regimes date from the proclamation of the Great Lebanon by France in the 1920. This event was followed by the establishment of the Bank of Syria and Lebanon. This bank was allowed to print money where the currency unit was the Lebanese-Syrian pound equivalent to 20 French francs. Later on, a monetary agreement was reached between the British government and France in which the French franc was set against the sterling. Consequently, our currency became pegged to both the sterling and the franc. In 1947, following its membership in the International Monetary Fund and the World Bank, Lebanon had to back its currency by gold up to at least 50%. In order to increase the value of the Lebanese pound and encourage capital inflow, the currency issuing body continued to increase its gold assets until the coverage rate in gold reached 92.2%. In 1963, the central bank was established and since then it works hard to prevent our currency from collapsing. Following the World War 2 and the civil war in Lebanon that subjected the currency to many ups and downs, governor of Banque du Liban, Riad Salameh pegged the Lira to the US dollar ($1=1500LL). It has been a credible commitment since 1990. But, given today’s fluctuations in international trade and the current status of Lebanon as a debtor nation, should the Central Bank continue to enhance a fixed exchange rates policy?

Many people ask what determines exchange rates. Why is $1=1500LL? Why not 3000LL, 1000LL or even 2000LL? To answer this question we should understand that history and the succession of events play a major role in the evolution of any currency. Lebanon is a good example since evidence show that the civil war has caused a major inflation followed by a depreciation in the Lira. The Central Bank had to intervene and set a fixed exchange rate between the Lebanese pound and the dollar that was believed to be the best possible outcome given our economic situation at the time. Overall, this policy has many advantages that are not limited to Lebanon solely. First, it helps reducing risk in international trade: buyers and sellers of goods can issue contracts without the fear that prices will change following a fluctuation in exchange rates before the settlement of their agreements. This certainty in trade encourages investment but also forms a drawback since risk loving people don’t get the chance to speculate anymore. It is known that a speculator seeks a foreign exchange risk or an open position hoping to make profits. When he expects the future spot rate of a currency to be higher, he purchases the currency today and hold it in a bank to resell it in the future and earn a profit equal to the difference between the current spot rate and the future one. He risks to lose if his anticipations were wrong for the sake of winning if they turn out to be true. This kind of risks can’t be taken in case a fixed exchange system was adapted by the economy. Another strength of this conservative policy is that it establishes discipline in economic management. Under this system the local economy is the only responsible of adjusting prices to re-launch equilibrium, it follows that governments will have not to follow inflationary policies that have harmful effects on consumers and on the society as a whole. If they do, they will have to tolerate high unemployment rates in order to reduce inflation and vice versa. This statement was justified by the Philipps curve, it showed a negative relation between unemployment and inflation. However, this relation was proved to be wrong in the 1970’s were the US and OECD countries suffered both a high inflation and a high unemployment rate. This fact caused the adjustment of the Philipps curve which became a relation between unemployment and the change in inflation since expectations about inflation turned out to be positive. This adjustment doesn’t mean that inflationary policies do not affect unemployment, it just means that we now have to deal with change in inflation: whenever unemployment exceeds the natural level the change in inflation will be negative, the opposite is also true. Moreover, inflationary policies cause balance of payments problems since monetary and fiscal policies are required to keep inflation constant. So, under the threat that the economy will become uncompetitive, governments will introduce a sort of discipline in their way to manage the economy. One more advantage of fixed exchange rates is that they eliminate the chance of any destabilizing speculation. This phenomenon is common during wars and recessions where exchange rates are low and they are expected to fall further or during inflations where exchange rates are high and they are expected to be higher. In this case, the speculator will sell the currency he holds, issue future contracts and bet on it falling further or he will work in the opposite manner depending on the economic situation. In both ways, destabilizing speculation will have destructive effects on the economy. If fixed exchange rates were adopted, the incentive to speculate will be reduced.

In the other hand many disadvantages were pointed out. Under a fixed exchange rates system, balance of payments adjustments cannot be made automatically. Whenever faced with a disequilibrium in the balance of payments, it should be solved by a change in aggregate demand. If we are running through a deficit, we should go for a reduction in aggregate demand to make people consume less imported goods, the price level will fall making the economy more competitive. If a floating exchange rate regime was tolerated instead, the disequilibrium in the balance of payments would have been corrected without any government intervention, so the domestic economy won’t be affected. If a deficit was in the picture, the currency would have fallen, making the economy more competitive again. To pursue a fixed exchange rates system large holdings of foreign exchange reserves are required so we can maintain the exchange rate. These reserves are known to have many opportunity costs. Moreover, we will have to sacrifice enjoying freedom in our internal policy since the needs to maintain the exchange rate will dominate the policy which can be bad for the economy in some situations. Interest rates and policies will be set in favor of the fixed exchange rates forgetting the macroeconomic objectives of inflation and unemployment, this implies that the regime will be sustained at the expense of the nation’s welfare. In addition, fixed exchange rates are thought to be unstable since countries tend to follow different economic policies which results in different rates of inflation. So some countries will enjoy low inflation and be very competitive while other countries will suffer from high inflation and lose credit for it forcing them to devalue their currency. This will form a great opportunity for speculators who will seek to make profits and cause pressure on the currency and on the government. The latter will find that it is urgent to enact to correct for this problem and may end up worse off as a result.

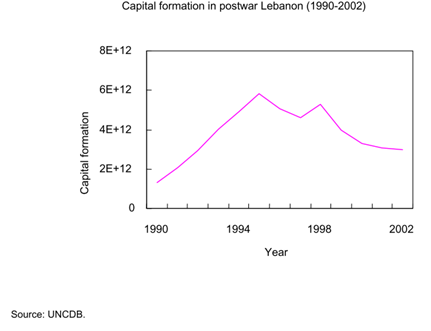

Looking closely at the case of Lebanon, we become able to assess how the fixed exchange rates policy affected the country both positively and negatively. Lebanon is known as an open economy with free capital movement and fixed exchange rates. The Lebanese business and investment summit held on 2010 considered this fact to be comparative advantage that we should work on developing it further. They stressed on the trade agreements and double avoidance taxation treaties. They also mentioned the advantage that we have given our geographical location and the service based economy that we have shaped. The main government goal is to sustain economic growth and create more jobs. They believe that adapting a fixed exchange rates system in the main element that will help achieve this goal. In fact, this system showed its efficacy in different situation since Lebanon enjoyed high growth rates in 2008 (9.3%), in 2009 (8%) and in 2010 (8%). What helped stimulate the growth is the trustworthy image that was projected to the world following the global crisis. The country succeeded in attracting capital inflows especially in the private sector where “deposits surged by 23% in 2009, amounting to 2.5 times the GDP” as mentioned in the business and investment summit. Moreover, the credibility of the central bank helped raising confidence in the Lebanese currency leading to a drop in the dollarization rate from 77% at the beginning of 2008 to 62.85% in summer 2009. The inflows allowed Lebanon to decrease interest rates and offered the country the opportunity to lend to the private sector. It is also believed that the financial regulation and the strict supervision implemented by the banking sector helped Lebanon going through the financial crisis with the least possible harms and established its current status as a safe haven for capital especially for the Lebanese immigrants who amount for more than 16 million today all over the world. In this context, we should mention the Lebanese diaspora who is contributing in stimulating the Lebanese economy through their permanent investments regardless of the bad situations that Lebanon is enduring. All these positive developments shown in numbers and coupled with the appliance of fiscal consolidation enabled Lebanon to decrease the debt-to-GDP ratios from 180% in 2006 to 148% in 2009. Moreover, freeing more resources to the private sector played an important role in reducing debts. It is important to mention here that the Lebanese debt is relatively small compared with USA debts which amount to more than 3 trillion making the US the largest debtor nation in the world. But what really makes the difference is the large GDP that the US enjoys making the US debt-to-GDP equal 71.8%. So, a better interpretation of the economy would be based on debt-to-GDP ratios analysis. One more point to clarify is that the fixed exchange rates system allowed Lebanon to boost capital investment which leveled from “1.6% of GDP in budget 2009 to 5.44% of GDP in budget 2010 and 5.17% of GDP in 2011”, as stated per the business and investment summit. These investments were used to improve the infrastructure, the power sector, the water and sanitation and the ICT.

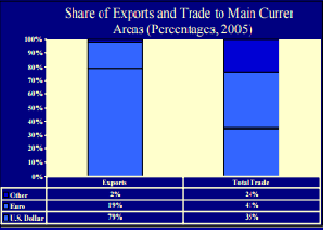

Even though the fixed exchange rates system has helped the economy and the dollar-debt percentage in Lebanon is too high which constitutes an incentive to peg to the dollar, recent studies argue that this system still suffers from many drawbacks that should be considered. Hamilton university website described the exchange rate as “the link between the domestic economy and the rest of the world”. It also affirmed that the Central Bank has to assign a fixed price of a foreign currency, usually that of a major trading partner, in terms of the domestic currency. But, when there are many trading partners as in Lebanon, the Central Bank should consider a basket peg. Given that the Lebanese economy is well integrated, it can benefit from the peg to reduce transaction costs. The graph below shows that the Lebanese trade occurs mainly with countries having U.S.D as their national currency or to which the national currency is pegged.

This graph shows why the Central Bank is right to peg the currency to the dollar but also shows the growing percentage of trade with Euro currency areas. This evidence is an incentive for the CB to start considering a movement towards basket peg including the U.S.D. and the Euro.

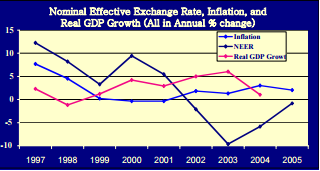

Looking at the terms of trade and their volatility, we would end up converting into a more flexible exchange rate to prevent Lebanon from going through large fluctuations.

Whereas, studying the correlation between inflation and real GDP from one hand and the effective exchange rates from the other we would be indifferent between pegging or not since it has no effect on the economic growth, it doesn’t promote it nor jeopardize it.

Clearly, whether it is good to have a fixed exchange rate system or not constitutes a highly debatable topic. Many economists believe that the CB does have evidence to support such a system but it cannot be implemented permanently because it will cause many threats to the economy.

It is true that Lebanon has been attracting capital flows but the main reason behind this is that Lebanese banks pay interest rates that exceed the ones set by the rest of the world. So, we are kind of subsidizing the deposits that flow into the country. The question that we need to ask is whether such a small country can keep on paying these high rates to attract funds or not. What is obvious is that the Central Bank is working on absorbing the excess liquidity from the private banks by issuing certificates of deposits that pay a high interest rate. This policy has harmful effects on the economy in the long run since a fixed exchange rate system coupled with perfectly mobile capital flows cause the monetary policy option to become ineffective. This leaves one last option to the government which is to implement an expansionary fiscal policy that increases deficits. The government would be willing to adopt such a policy even if it means that it has to borrow more because it believes that it will help grow the economy in the future and settle the debts. This can work only if we return to the world interest rates, but this means that capital flows will be highly reduced which makes some people think that it will be bad for the economy.

We should understand that the real problem in Lebanon lies in its national debt. If we enjoyed a relatively small debt-to-GDP ratio then a fixed exchange system combined with perfect capital mobility would be a perfect policy. In this case, we would apply pressures on the interest rate to rise using fiscal policies and the central bank would counter that by increasing money supply. This isn’t applicable in Lebanon because of the large debts and fiscal authorities are expanding deficits to budget activities that has no efficiency or ability to pay off our debts in the future. They are simply financing non-productive activities driven by corruption which is so common in Lebanon. All these factors result in a muted response by the BDL. A healthy economy cannot pursue on subsidizing the capital inflows. So, the Central Bank attitude is surprising. They end up forced to buy the extra liquidity from the commercial banks at high rates so that the banks can afford to pay the high rates in the first place! Flexible Exchange rates is the best system that would deal with this problem by imposing a certain discipline that the different authorities should follow. The Lebanese government should understand that it has to cut its deficit, and not expand it. It should take Greece as an example and use its diversified resources to pay off the debts. We enjoy a perfect geographical location that resulted in a moderate climate suitable for agriculture that can help us gain self-satisfaction. We also can take advantage from the excessive quantities of water we have to improve the electricity. Furthermore, we should give close attention to resources that constitute raw materials such as petrol and gas. Finally, if all of the billions paid to subsidize capital flows had been invested productively and efficiently; they would generate sufficient returns to service our large debt. In this case a monetary expansionary policy would apply downward pressure on the exchange rates which will be offset by the expansionary fiscal policy that would be initiated by the lower exchange rate. The net result will be an economic expansion without altering the exchange rate that existed before the process started.

References

About Banque du Liban- History of Banque du Liban. Retrieved from: http://www.bdl.gov.lb/about-banque-du-liban.html

Advantages and disadvantages of fixed exchange rates. Retrieved from: http://www.bized.co.uk

Can Lebanon afford its current fixed exchange system? Retrieved from: http://yalibnan.com/…can-lebanon-afford-its-current-fixed-exchange-system/

Evaluating the peg in a small open economy- the case of Lebanon. Retrieved from: http://my.hamilton.edu/levitt/postertamim.pdf

Macroeconomics, Olivier Blanchard, Prentice Hall.

Salvatore, Dominic. International Economics Trade and Finance. Tenth edition.

The Lebanese business and investment summit. Ministry of finance. Retrieved from: http://www.finance.gov.lb